Look, I’ve been warning of the inherent risks and problems with NFTs and have explained why the current NFT solutions that use the current iteration of blockchains do not, and cannot work for a whole multitude of reasons. Mostly because a ‘token’ is completely worthless and it isn’t linked to the thing, asset, picture, the piece of art, you think you have purchased.

I do think Non Fungible Tokens are a great concept, and the decentralisation of blockchains should be the perfect technology to create new stores of value for artists and creators to benefit in a trustless, secure approach. They open opportunities for creators, for artists to earn new income by creating secondary trading opportunities for collectors, fans and speculators. Unfortunately NFTs are likely to go down in crypto history as another learning curve, must try harder as early adopters loose a ton of cash and it all goes pear shaped.

Blockchain records token movements, not the thing, (the asset) you think you have purchased?

Note: I used the term ‘asset’ in the rich sense of the items being purchased — a piece of art, a collectable, antique, picture, song, software, message, anything perceived as valuable by the Buyer and Seller.

The primary issue is a blockchain only records token movements. That is it. When you buy an NFT you send token from your wallet which is written to the ledger, this happens on the Sellers blockchain (or marketplace). There is no ‘exchange of value’ coming the other way? The asset is not held there.

The ‘pink slip’ receipt is often a link in a script (the infamous smart contract), pointing somewhere. The script points to a URL where your asset/item/thing resides comes with a JPEG or PNG as a receipt as evidensed confirmation. The problem is JPEG and PNG files can be Copied and Edited like every other piece of data on the Internet. As soon as the message from your smart contract hits the Internet (Boundary Gateway protocol — which has no native security encryption), to sync with the other blockchain, it creates aByzantine fault, and you will be spotted and hacked for sure. New copies of what you purchased will be bought and sold in minutes.

The asset your token is apparently linked to, but isn’t, sits on another blockchain. Not the one where you paid and handed over your tokens, that probably started as USD, Ether or Bitcoin.

Its like buying a car, paying at one dealership and turning up with evidence of payment, but doesn’t describe/mention the thing you have purchased? Hoping the other dealership has the exact same car you have been sold, however the log-book is held by a diffrent third party, but hopefull the dealer will let you drive it away!

When you are Buying and Selling on different blockchains, with services, assurance, custody and the storage of the assets relies on several parties — you get where I am coming from.

Who are these other parties? Providing decentralised Storage, or Notary or Custodian functions that confirms the validity of what is going on, apparent uniqueness and bonafide transaction. Are they qualified? Whos interests do they serve?

Another observation is the Notary and Custodian creates a ‘centralisation effect’ in terms of governance and verification process — using the same approach as a central bank in our financial systems. They have become a centralised authority on which the NFT purchased depends? And lets not discussed Proof of Stake protocol that compunds the issue. And yes evrything is probably automated via smart contracts, but who has written these scripts, and checked (audited) is not clear? Is there a back door? And what happens if the custodian goes bust? Or the parties fall out and decide to not play nicely and ransome the system? To get you ‘asset’ you have to pay absorbitant fees and charges?

NFTs introduce the ‘double spend’ of data issue

When Satoshi solved ‘double spend’ for Bitcoin payments, a world of true democratic electronic cash/payments become possible. It was a seminal moment and launched the decentralised world of crypto. However, what seems to have happened as the NFT platforms try to make blockchains work is they have reintroduced ‘double spend of a data’ issue — as a JPEG and PNG can be copied, and the file has no unique version control that can be tracked and traced. we appear to have taken a step backwards. Opening yet more Byzantine faults.

Where is the transparency of all the moving parts? The asset is managed by a third party diffrent to the one selling you the token. Are they good or bad actors? How do the various parties in the NFT chain make money — are the terms and fees/price fully disclosed? How is the details about the NFT stored, protected and the original ownership confirmed? How was the provenance of the asset confirming it is real, not a copy and unique, achieved?

One has to remember there is a fundamental difference to gaining ‘access’ to something, your asset, and the ‘ownership’ of the asset, that comes with redemption and other rights? Do you really own it? Did the Seller have permission to sell? Was it theirs to sell? Is this data and critical information bound to the NFT transaction to make it valid and deliver confidence?

The acrid test, can the NFT purchase be immediately reconciled and audited. Can they show you the end to end transaction? And your NFT seller (platform) operates where (jurisdiction) exactly? Who are the directors of the company?

NFT platforms are unable to guarantee or confirm the location and state of the asset. Blockchain protocols such as Ethereum have no native ability to track and trace assets that are associated with the token, which is NOT the asset. If the platform and NFT is built on Ethereum -a ledger based protocol, it doesn’t have this function, unlike Bitcoin PoW that works on the basis of UTXO.

So youve heard why NFTs dont work as currently engineered, lets explain how they can and should work as Non Fungible Assets (NFAs).

Making NFTs work, as Non Fungible Assets

The only way to do this properly is to offer Non Fungible Assets, yes an NFA which is structurally different for a range of sensible reasons.

Firstly, the token and asset exchange happens in the same transaction, under a legal framework, the same as traditional Capital Markets today. Bob send Alice 10 BTC to buy an asset and Alice confirms the exchange of the asset — the transfer of rights, of access and/or ownership, are bound together called a ‘dual double entry’. This happens at the same time under a formal basis of Law for all to see.

Secondly, the transaction is bound together ‘atomically’, that can be instantly validated, audited and checked. If the Buyer isn’t happy they have a legal basis for recourse, as the process provides comfort on both sides. Remember with NFT platforms there is no basis of law, and the is no link between the token and the asset.

Thirdly, the underlying asset (picture, memorabilia, art, song, car, antique, painting) and all details about what is being paid for, the asset details, provenance, to create a NFA is passed through a ‘smart data protocol’ that adds attributes to asset and creates a rich set of information for your NFA transaction ( an intelligent file format containing, date and timestamp, authorship and ownership and provenance, price/value and the legal jurisdiction code and more). The entire transaction becomes a ‘smart data’ transaction confirming originality and uniqueness but most important of all, its unique ‘state’ is known.

This is essential for three main reasons — first, the asset can be ‘tracked and traced’ across the Internet, and second the trading of the asset backed NFA becomes instantaneous, trusted and secure, and thirdly this happens within the same blockchain — ‘technology stack’ — where all the parties are known and the rights of the buyer and their claim over the NFA is visible.

Remember NFTs have no intrinsic value as they are worthless ‘tokens’ whereas NFAs represent the exchange of ownership of the real ASSET that comes with rights and legal basis for trading, with value and price validated.

How NFA’s work:

The new approach introduces the fundamental concept of ‘Smart Data’, a decentralised file format leveraging the power of encryption and blockchain technologies to create programmable data that can be truly owned, with identity, rights, intelligence and privacy embedded at the data level within a framework of law.

Smart data is about to become fundamental to the entire entertainment, sports, gaming industry and will revolutionise the asset and fund management industry, with much broader implications for all capital markets and trading activities.

About the Author

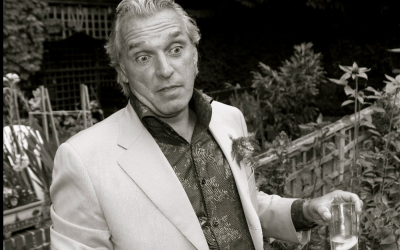

Nick Ayton is a strategic board advisor to several businesses and a general Partner at Solarix-Ventures who focus on Deep Technologies and matching these with intellgent capital.

Author #NickAyton © 2021 is a futurist, technologist, speaker and writer on all things deep tech.

@NickAyton