Notice: I was asked to write a follow up piece after the piece on Myths of STOs where some were asking me to expand on the STO processes, the current market behaviours and regulations.

You often get a bit of residual heat when what you write resonates with certain people in our community. I am not going to name names here unlike some people, but they are easy to find and we know who they are…

Knowingly or unknowingly breaching the rules lands you in trouble…

We come across many participants in the community working on STOs (Security Token Offerings) are directly breaching the FCA Regulations on Financial Promotion, and we can guess whether this is knowingly ( I wont get caught) or unknowingly (where ignorance rules the day) . Their actions will hurt us all and I am afraid its more the latter. And it is not just FCA, every jurisdiction has similar or same capital markets rules.

I have unfortunately seen some websites offering to publish STOs, rate Security Token Offerings, yes rate and assess projects that are issuing a security without being directly authorised and/or regulated and yes, they charge a fee… A bit risky unless you are Regulated or in the US a Dealer Broker…

Rating and Assessing. Without revealing who is doing the assessment, whether they are qualified or not, what the criteria is, although non of that matters. Because only licensed and or regulated firms may work on securities, and only the likes of Moody’s and Standard & Poors may Rate Securities and other tradable instruments, although I have been told frequently , “Nick you don’t understand, you have no clue about STOs, what we do is different!” Well I have news for you, it doesn’t matter what I think, it is after all down to the regulators in each geography.

And so you see Rating a Security is not allowed unless you are an authorised Rating Agency. A professional third party a la PwC may provide supporting information as to the valuation of a company that issuing an instrument, another may assess the token is compliant to regulations, another relating to due diligence and company procedural checks and best practise. These are professional firms and in most geographies hold various regulatory licenses. But all work within the relevant laws and avoid producing market facing information that can mislead the investor (token buyer).

You know that old ICO play, “Pay us some money and we will rate your project” , “Pay us a lot an we will rate it higher”. Well in Capital Markets you are also not allowed to charge fees associated with certain services, especially if the fees are related to capital raising.

Financial Market Manipulation

Unfortunately in STO-land this equates to what is known as financial market manipulation. Publishing misleading, skewed or paid for reviews of projects, STOs companies, and their offerings, a Security, is seen as financial markets manipuation as may encourage directly or indirectly someone (an investor) to buy a security based on misleading information, especially paid by the issuer. On some sites they are shown as Sponsored which gives the game away somewhat…

Also please tell me what is wrong with this statement. The Primary Issuer, the company creating and selling the security token hire third parties to help them promote the security. They also pay to have their security token project assessed and rated!

Rating Securities

I have witnessed unauthorised, unregulated and unknown (not disclosed) people advertising in the Blockchain, ICO community that they rate Securities.

Get you Securities project rated here, for a fee of course!

Community has a Problem

I saw on a Whats App chat recently someone refering to ICO and STO advisors as ‘rainbow chasers’ and we know how that ended in ICO-land. Whilst not all were bad people, and I know many very good advisors that place the interests of the client before their own, however it is clear many were in it for a quick buck. Many have now left the field of play, while others have replaced ICO with STO without a care or realisation there is no correlation here.

“STOs is the process of digitisation existing financial instruments as software code written to the Blockchain, delivering transparency, confidence, efficency, faster and lower cost means of private companies raising capital and for the first time private companies having access to secondary markets to trade their value”.

The problem is this opportunist community are tempted to move into Security Token Offerings without having knowledge or skills in Capital Markets let alone the coding skills necessary to engineer financial instruments as smart contracts reflecting a compliant financial instrument. While others truely believe they can disregard securities laws because STOs are unregulated and thus the rules don’t seem to apply. Well good luck with that position.

I have seen websites with open promotion, so called sponsorship of STO projects, with links to the projects site where you can buy a token, without the necessary disclaimers, permissions and notices, are a direct breach of the Financial Promotion laws. Whether oral, written or via website, news and information, ‘real time’ promotion or via other channels remains Financial Promotion.

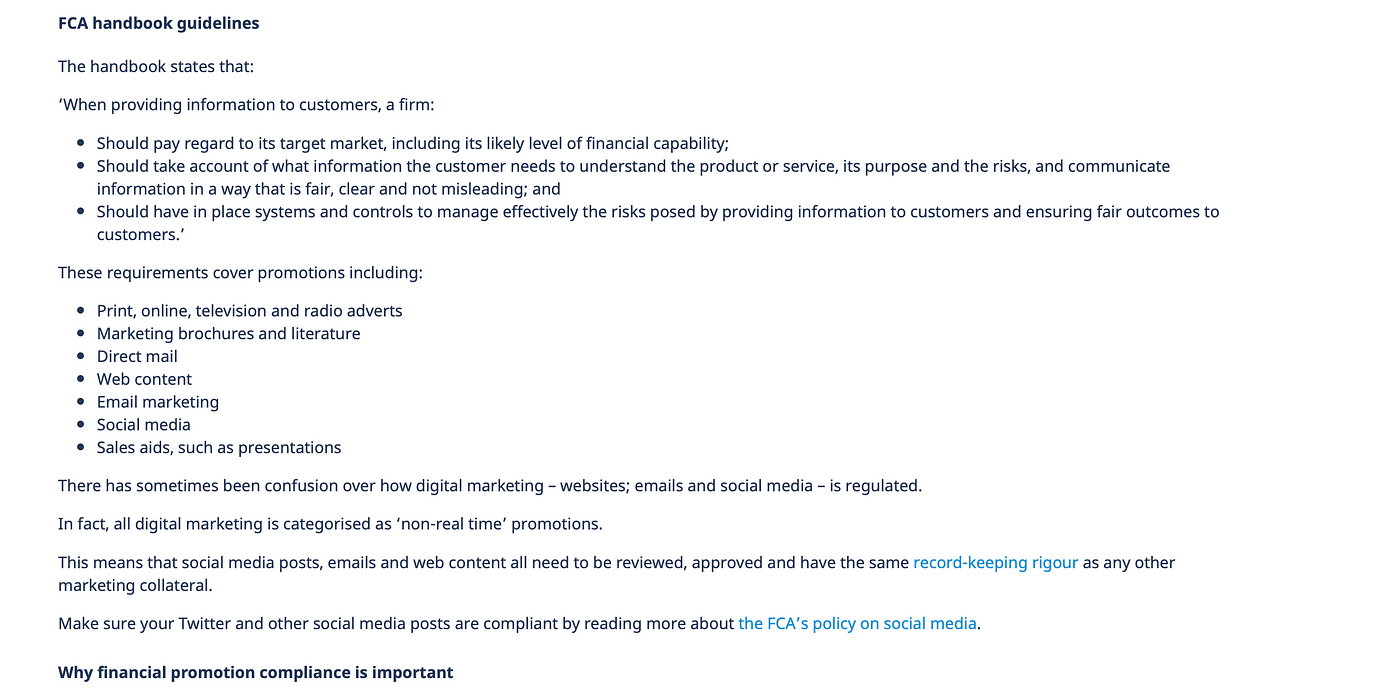

FCA Handbook — Financial Promotion.

The rules around Financial Promotion are clear and now for part, in the UK, the FCA Handbook. In all other territories similar rules apply because after all we are dealing with financial instruments, as Securities.

Which ever terms you prefer, tokenisation of shares or debt, digitisation of equities and loans, we are talking about financial instruments that fit within existing Securities Law.

Whether you are an arms length advisor, marketing and PR firm, primary issuance platform, a site that rates project (ICOs and STO) or secondary trading exchange, when it comes to STOs one has to take responsibility for acting responsibly. The interest of the investor is primary.

Let us not forget rating ICOs for money has two potential issues. (i) what if the token is deemed a Security and not a Utility, and you have rated it? (ii) Rating a token for a fee to encourage someone to buy it with their hard earned currency (notwithstanding ALT coin profits) may still be held accountable for market manipulation, financial promotion given the encouragement and promotion is based on false or knowingly misleading information. Buyer Beware Ok, but buying on skewed and knowlingly misleading information is a different matter.

Who can talk about and promote STOs?

Let us remember that there are only two parties that can freely promote their equity for example. The Directors of a private business are entitled to sell equity to investors, often in private because there is little or no markets for selling equity outside a crowdfunding platform that tends to focus on early stage opportunities. And of course Crowdfunding and Collective Investment Rules may apply, for tokens that act as pooling instruments.

The other party are already listed (publicaly quoted) business can freely sell their equities or bonds as they are bound by prevailing Capital Markets regulation that provide a wrapper for their instrument, as tradable security that delivers confidence to the investor and has demonstrated due scrutiny.

Other than that only regulated business may get involved in the promotion of a financial instrument. So online print, brochures, adverts (listings), mail, web content, social media and presentations count.

I was trolled recently by the haters, they said Nick why don’t you mention your client projects on your website? The mere fact they were asking? And why we will put out PR statements from projects that have been vetted by the issuer.

It is up to our community to clean up our act when it comes to Security Token Offerings. We have to demonstrate we are worthy to operate in this market by following the rules. Playing by the rules is expensive, yes it is bureaucratic. But this is the only ticket to play. If you don’t like it, don’t play, but don’t make up your own rules to suit.

You cannot rate Securities, you cannot comment on them, you cannot promote them, you cannot sell them, only the directors of a primary issuing company can do that and a regulated trading exchange.

“Ignorance is Strengthened”

#STOs #SecurityTokenOfferings #SecurityToken #Regulation #FCA #FinacialPromotion