Have we found the god protocol?

With the explosion of interest in cryptocurrencies in recent months that saw Bitcoin pump and 100m new wallets opened, large asset manager BlackRockslow to the party made a move investing blockchains and mining. The Elon Musk effect shows how fickle Bitcoin can be, with MicroStrategy doubling down on a BTC BUY strategy, and of course the feeding frenzy around NFTs and DeFi projects — investors are looking for the next Bitcoin.

We know investors like to get in early as the multiple crypto-billionaires can attest. Everyone now realises Blockchain as a significant technology is here to stay. We have witnessed the explosive growth in the value of Bitcoin, and their forked brethren Ethereum, whos recent move has surprised many, have accelerated Ether supply, that will impact price at some point, versus Bitcoins fixed supply, an important factor is supporting price.

But here is the thing, the investors who were not early adopters, and that is 99% feel aggrieved they missed out when BTC when it was under $100 or even $1000. They didnt see the light early enough, further annoyed because they also missed out when Ethereum was under $50. In many ways investors at the time were forced to accept second best as they pile fresh capital into new projects built on Ethereum — Solana, Polkadot, Chia Network andAlgorand. In a way its like eating second hand protein — known as meat. The price paid already at a few dollars and not $50cents. It’s worth remembering $100 spent on BTC in the early days would be worth $30million++ today.

The primary issue with investing in blockchains built on another protocol stack — Ethereum, they cannot experience the same gains as pure ‘protocol tokens’ of which there are few. The world needs new blockchains that can surpass what we have today, correcting some of the technical shortcomings and most of all offers something fundamentally different. In other words we need a real ‘breakthrough technology’ which is incidentally one of the pre-requisites in Peter Thiel’s investment thesis described in his book Zero to One.

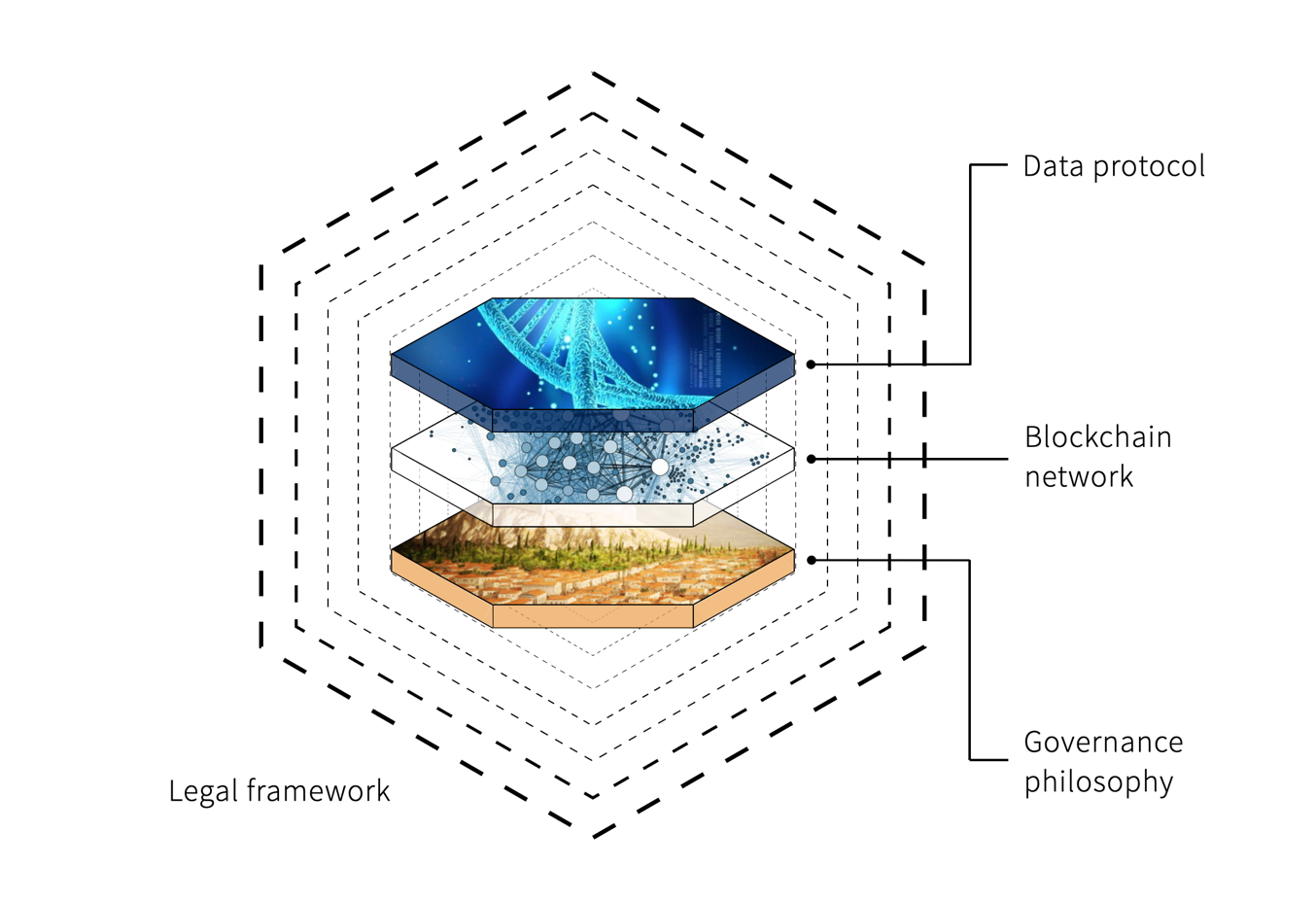

The key differences are easy to see in the diagram below.

People are asking: Is the Zenotta’s protocol the new Bitcoin?

For many fans and supporters the answer is a resounding YES. This is because Zenotta’s solves the limitations and technical issues of Bitcoin, and probably why several leading economists have predicted Zenotta could become the first multi-trillion Market Cap token!

Yes, you heard it here. Whether this is true, one cannot bet against an experienced team that have spent 7 years building the infrastructure protocol — all of which means Zeno, the native Zenotta token, will become an important part of any investment portfolio, as a great hedge. Even better news is the price is low enough to afford a sizeable chunk of Zeno tokens for your money, ahead of the public listing.

So why haven’t I heard about Zenotta?

A legitimate question you maybe asking — where has Zenotta been until now? Is to too late to get in early? What does it do that Bitcoin and Ethereum do not? All solid questions answered next.

Zenotta started life at around the same time as Ethereum in 2014/15 but chose a different engineering and philosophical path — preferring to stay close to the original Satoshi vision. The team spent the past 7 years in development or what people refer to these days — stealth mode. They went into their cocoon and have now emerged as a beautiful butterfly, and like all butterflies have an entirely new DNA born from the original caterpillar containing Bitcoin origins.

Yes that’s right — Zenotta delivers an entirely different functioning blockchain technology stack, considered to be the ‘fundamental protocol’, and like Bitcoin and Ethereum follows Metcalfe’s Law. Zenotta has fixed supply (like Bitcoin) whereas tokens built on Ethereum using ERC20, have constant supply that will one day inhibit it from reaching their full potential, drowned in a mixed bag of good, bad and ugly projects all built on Ethereum.

In some ways Ethereum is a victim of its own success and network fees have rocketed. Something to do with the move to ‘staking’ which for me allows those who can afford to loose their stake, commit resources to win over the little guy, will have Satoshi tossing and turning in his bed at night.

Zenotta is the first new fundamental PoW (Proof of Work) blockchain, and like Bitcoin stands alone. With Ethereum moving to Proof of Stake in a few months on the grounds of efficiency and performance, one can’t help thinking this is an inherently bad move for holders of ETH, and Miners that now need something else to mine. Bitcoin was the first and remains the ‘daddy protocol’ and why it leads the Market Cap and performance of the entire crypto community, which is sort of a problem, as it too has become more and more centralised.

The smart Ethereum community may be tempted to move over to mining PoW Zeno tokens in the months ahead rather than sell their hardware. One is naturally drawn to power needs of the PoW consensus, requiring lots of computational processing — a bit like fishing the seas, has moved to industrial scale that impacts the environment and has caused Bitcoin to become a store of value play, and not the peoples payment channel for which it was designed. In this area Zenotta has answers too.

Satoshi’s real vision was…

However many core ‘Bitcoin maximalists’ have ongoing concerns the true vision of Satoshi has been usurped. Somehow the Bitcoin network has shifted paths from the purist path as per BitcoinCash and BitcoinSV forks, each arguing their true path. There is a growing number of Bitcoin core community heralding the new Zenotta protocol as a closer fit to Satoshi’s paper and more closely delivers the original vision.

To begin with, out of the box Zenotta is a true Peer 2 Peer payment system for the people, delivered by a mining network that allows everyone to compete to validate the block, write the block and earn the reward, no matter what equipment you have — a true égalité fraternité, utility, commercialité…

The primary issue with Bitcoin is there were no safeguards that prevent network centralisation, resulting in a land grab based on resources, crushing real competition. Witnessed by a handful of dominant mining pools that many believe cheat the network, and let us not forget control the supply and distribution of ASIC mining equipment, whos price has increased 5 fold. Mining is no longer a fair game, maybe it never was, and now some have found a way to gain the advantage over network latency being first to receive new transactions.

It is true Zenotta solves many fundamental technical issues suffered by Bitcoin — offering almost unlimited scaling, orders of magnitude lower energy consumption, a thermo-dynamic based equilibrium mining protocolthat prevents centralisation, and a true Peer 2 Peer electronic trading and payment system, with a difference.

Zenotta’s Killer Apps

The Zenotta payment network is a killer app. For the first time when you send tokens to another user, the network sends you a ‘receipt’ — yes, a receipt. This is a very big deal indeed. Why? This allows a crypto payment network that is instantly auditable, that can challenge PayPal, Visa, Stripe.

The second breakthrough is what is called a ‘dual double entry’ that records both sides of the transaction, both sides of the exchange of value, unlike both Bitcoin and specifically Ethereum only records token movements and shows balances (the exchange isn’t recorded because there is no exchange of value) and why ERC20 tokens have zero value. An user sends tokens to someone else to buy something, which isn’t described or recorded. The very thing/item the tokens were exchanged isn’t part of the transaction? This makes it a little awkward for handling NFTs and other peoples money in DeFi platforms, and virtually impossible to audit in real time, and fees make it costly to do so.

The most significant technological advancement is the Zenotta file systemthat uses ‘smart data’ as the basis for creating, exchanging and storing value. The significance of which is shown by the number of NFT and DeFi platforms are now looking to engineer on top of Zenotta’s infrastructure. This is because they realise all files have a ‘state’, (an NFT) which identifies it as uniquely owned, is time and date stamped, can be natively tracked and traced anywhere. This allows all ‘rights’ to these smart data assets, their value and ownership can be immediately exchanged and traded in a single technology stack — and why some have called Zenotta the god protocol.

As Andrew Kessler CTO and Co Founder explains?

“A digital world needs digital content that can be owned. A data-driven economy (democracy) needs data that is sovereign, with rights, emancipation, and identity. A world where data becomes a digital asset, empowering artists, content creators and individuals, as well as businesses and institutions of all kinds. We are entering a realm where all data will have value and be traded.”

Did you miss out on Bitcoin first time around?

So if you thought Bitcoin was a fad and missed out on getting in early, you now have a second chance. If you thought Ethereum was just another get rich quick scheme encouraging ICOs, now is your chance to get in early on the next Bitcoin. But a word of warning, getting your hands on Zenotta tokens isn’t going to be easy. There is significant interest in ‘Zeno’ tokens and a long ‘wait list’ as people get ready for the public sale in a few months time. The reason Zeno is priced in cents currently, it is a token you just have to own and have as part of your portfolio.

Will Zenotta be bigger than Bitcoin and Ethereum?

Zenotta offers a fundamental opportunity to engineer things (business models) differently, using ‘smart data’ as the central structure — is a significant opportunity to advance commerce. This is another ‘killer app’, but there are several more killer apps. The network layer 1, the data protocol layer 2 and Zenotta has a layer 3 — a governance (legal) layer that supports a common basis of International law and arbitration. This is another significant breakthrough moment, for the first time commerce can be conducted on a blockchain where both sides of the transaction is recorded, a receipt is issued and the Buyer and Seller relationship is supported by Law, and natively GDPR compliance.

When one also considers this happens inside the same technology stack, you start to see why this is a huge deal. There are no side chains, third parties and an array of multi layered ‘smart contracts’ that one hopes can tie everything together — pointing at oracles, storage, custodians and other independent third parties. As the projects building on Ethereum can attest simply writing and retrieving things in the Ethereum network, creating an NFT and listing it in an NFT Market, executing scripts incurs high transaction fees, and as many projects have found out, miners can refuse to process your transaction, unless you pay more and more. Not good for any business model as transaction costs need to be reliable, and you need to know the transaction has been executed.

This is why a growing number of people see the Zenotta protocol as a fundamental advancement of commerce. A blockchain protocol that offers the protection of peoples rights as content creators (owners), creating instant trading opportunities for buyers and sellers of everything. Enabling all people to trade their value with the full protection of rights, privacy and law, which let us not forget all happens in a decentralised environment.

The Zenotta infrastructure ensures everyone has sovereignty over their assets and the things they own, because every piece of ‘smart data’ has Identity Based Ownership (IBO). This means all payments and royalties due to the creators of content happens automatically — no fuss, no time delay and no issue.

And yes, Identity is retained by its sovereign owner, the User, and not used to make money at others expense, the main income stream of social media that abuses the basic human right of privacy, and they pass data to surveillance authorities without your permission. Another big deal.

It is worth reminding everyone why data has no value, this is because data can be Copied and Edited across the Internet. All data is fair game and anyone can Copy someone elses’s content and bemnefit from it. Making cliams over it and deriving income from it. When you give data value (creating smart data files) everything changes and the Internet of Value is created, where the ‘state’ of everything and its ownership is known at all times. The User decides who sees their data, who can buy and consume it, retaining core rights, to automatically receive royalties or transfer rights in perpetuity.

Is this why investors who are looking for next Bitcoin see Zenotta as the strongest candidate yet and keen to be part of the next token placement roundahead of the public sale, in a few months time? One thing is for sure its going to be a big one and this time around those who missed out on Bitcoin, won’t want to do so again.

Twitter @NickAyton

Linkedin: www.linkedin.com/in/nickayton

© Copyright Nick Ayton 2021

About the Author:

The author Nick Ayton is not offering financial advise and is not recommending a financial security or product. This article is for information purposes only. All investors, buyers and interested parties should complete their own due diligence and research into Zenotta.