A digital world needs digital content that can be owned. A data-driven economy (democracy) needs data that is sovereign, with rights, emancipation, and identity. A world where data becomes a digital asset, empowering artists, content creators and individuals, as well as businesses and institutions of all kinds. We are entering a realm where all data will have value and be traded — but are the current Blockchains up to the job of NFTs?

Let’s face it would you buy and NFT — Non Fungible Token? The only people that seem to be buying these tokens are the crypto whales as a means to park their crypto so they don’t have to pay tax, or people sold the dream the NFT will go up in value due to scarcity and originality, although as you will find the token to be completely worthless. Please note that just because crypto whales and millionaires have accumulated lots of crypto to spend doesn’t mean they are right or know how crypto works. Many got lucky, took a ‘punt’ on BTC in the early days while others ars are intuitive traders that play the emotions of the crypto markets.

Well there is nothing like a bit of ‘front running’ to get a market moving, right! Look I have nothing against NFTs, they are a great concept. The issue is the engineering of them, today doesn’t work.

When you buy an NFT what actually happens? What do you get? Well, you sort of own a ‘token’ that is meat to give you rights of redemption and ownership in something. An asset, — some art, a car or something else maybe. The problem, it doesn’t. Not even close. Yes you own a token which is natively worthless, unless all the market participants agree to be honest and agree that you have access to the thing you bought, and its price will be honoured. Good luck with that one.

Unfortunately 90% of people in blockchain still don’t understand that a blockchain only record token movements — that you have handed 10 BTC to some address. It doesn’t record what was actually purchased although the NFT platform may tell you their smart contract handles, verifies and does the rest. Which is sort of a lie. Primarily because a blockchain cannot do this, nor can you write data directly to a blockchain. And that means all of them. To keep blockchain secure, immutable and safe, only the movement of tokens is recorded — this is because as soon as outside data/information/communications happens, the properties of a blockchain to be safe and its consensus disappear.

I will explain how NFTs can work, so keep reading.

Why the current generation of blockchains struggle with NFTs?

Look NFTs are indeed a great concept. But they are currently not engineered properly because the underlying blockchain, and consensus model aren’t up to the job. For example, any ‘ledger based’ protocol such as Ethereum (rather than unspent) has no native ability to ‘track and trace’ tokens that are apparently defined as either a security or asset token (linked to a commodity or something of value). All kinds of shenanigans have to happen to fudge this, including a sort of re-centralisation effect that comes with many promises by unrelated third parties.

Unfortunately the asset you think or are told you have purchased, is somewhere else, and the binding authority that confirms ownership is also somewhere else. A sort of custodian or notary services maybe, however the problem this causes is it adds yet another layer in a tech stack that has suddenly become more vulnerable not less. So rather than removing the centre, and the human propensity for fraud, NFT solutions involve too many new parties and rely on trust between chains that is not atomic, and not guaranteed. The ownership of what you have purchased is or isn’t validated (real or copy) is also held elsewhere, and certainly not part of the one sided token transaction, which isn’t a real transaction, just an entry to an account probably on Ethereum.

To put it another way. Imagine ‘buying’ a car, where the money you pay comes from a bank, is recorded by the bank, however what you have spent your money on is only mentioned in a script that contains a link to Autotrader picture of the car, or maybe a picture or video of the car at the ‘sellers’ end. The sales confirmation receipt is also held elsewhere — maybe at the dealership. The service recorded and provenance of the mileage is also held by the dealership that serviced the car previously. Or maybe there is a finance company in the loop that lends you the money?

All the information is there but held is different places, on different systems, with different ownership, security and levels of trust. This is the same in the NFT space where the logic of the entire system relies on a range of ‘smart contract’ logic, created by people who are paid by different businesses, whos morals and loyalties are also unknown. The further issue here is the continual audit of the smart contracts to ensure they work, have not been changed or receive a sort of ‘in out’ instruction that triggers a back door. The bottom line is this code base is unlikely to have been audited end to end and repeatedly checked, as each third party would endure cost and not income.

So you’ve handed over some BTC to buy an NFT, the tokens recorded in an acount on say Ethereum, at an address, not a file. The thing (NFT) you have purchased is probably mentioned in a solidity script, that contains a URL link pointing to a website or JPEG or PNG file destination address. And then lets not forget ‘rug-pulls’, where the owner packs up and disappears with the assets you have paid for, or decides they didn’t want to to sell to begin with. And yet some NFT platforms claim the asset is apparently linked to another blockchain that hosts the asset if by magic, or describes the asset or confirms the storage of the asset in a digital sense. But again all this happens somewhere else and they are not bound as a single transaction or under anything recognised as commercial law. Yes, you heard it right.

What you have purchased for the crypto you’ve handed over isn’t recorded along with the exchange of tokens, some try to call a transaction, which it isn’t. There is also NO basis of Law that protects the Buyer of an NFT! Do not let anyone convince you otherwise. There is no recourse and any redemption rights granted are not part of the token exchange, and also not valid under any form of arbitration either. And to call it a token exchange is also stretching the truth because it is one way.

There is no exchange of value going on. Alice passes 10 BTC to an NFT platform that issues an Non Fungible Token! Which has no value unless bound to the asset.

Here is the other issue.

How do you know what you have purchased is real?

How do you know what was purchased is the real thing? Is the provenance proven? Is the owner of the asset you have apparently purchased been validated? How do you know who is looking after it? The problem is everything can be Copied and Edited when its digital (this includes JPEGs and PNGs) and these files have no unique properties, and why ‘data’ in generic terms has zero value. Is why the Internet doesn’t work and destroys the value of everything. All because of Copy, Edit, Paste. Unless the data is smart that is — smart data changes everything.

NFT platforms will tell you the assets have been validated, but often won’t disclose by who, of share the chain of title which remains unclear, apparently due to privacy? Who is the owner, do they have permission or simply access, given access rights does not equate to ownership. The NFT platforms then try to create a chain of title between blockchains that has no interoperability. None. Then there is the identity of the buyer and seller which are often missing. Are the parties known? Are they real and are they good actors. And this is where crypto falls down so many times with the demand of the purist for anonymity.The notion anyone can buy a token that is linked to an asset, as an NFT is wrong!

The item you purchased is not recorded on the ledger, only the token amount is recorded, but it is not for an ‘exchange of value’ at all. There is no value coming the other way. All you have is the transaction ID on Etherscan or the location URL, that is vulnerable to be copied, changed and closed off. Good bye crypto. Good bye asset. No really, I like the core principle of NFTs and yes they can work, but need re-engineering to work, so do keep reading.

There is no exchange of value as NFTs stand today

Example: Bob sends Alice 10 BTC to buy a share of a painting , BUT what Bob receives isn’t recorded on the same blockchain. Bob sending tokens is not atomically bound to the token exchange or apparent value exchange, part of (combined) single transaction. The recording of the asset you have purchased happens elsewhere, probably held and serviced by another business, whose ownership, morals and security status remains unknown. In any event you’re adding ‘t’ connectors to the plumbing that introduces new vulnerabilities that will be exploited. The attack surface area has all of a sudden got wider.

The blockchain that records and holds the assets doesn’t record the token payment (because it didn’t happen there), so if there is a dispute or a need to validate or audit what went on, you cannot. The information isn’t held or recorded in a single tech stack. The parts of the transaction sit in different places, and who knows if they are complete or have been changed when they are reassembled? In this model there cannot be a single truth of what went on that is tamper free.

It is obvious what NFT platforms are trying to do here, with so many parties involved, interlink chains and smart contracts to deliver the hands-off process logic. But there are gaps, too many known unknowns and Byzantine faults everywhere. Its because the blockchains they are using cannot do everything in the same stack, and if they build on Ethereum as a ledger based protocol using accounts not files, the complexity increases and with it transaction costs making it uneconomic.

It is worth remembering blockchains only have important key qualities because they are self contained. When you have to get the information from elsewhere, the script calls to an oracle, or deals with a storage node, everything comes at an extra cost, and doors (channels) are opened. Byzantine faults appear as messaging has to break cover and can be intercepted.

The compute cost to run the script that executes any instruction to do something gets expensive. Each off-chain or chainlink structure is owned by another business, has different rules, structures and protocols. They will charge you fees to execute a simple script (pay for compute power) to simply report on a change or movement of assets and title, however to create an full audit of everything? A process touched by different third parties who have access to change things? How safe would this be anyway?

The informartion as to who these people (third party participants in the NFT platforms network) remains unknown? There are too many parties involved. Also who wrote the smart contract is probably not the business owner, may a contractor, who motives remain unknown. Have they be tempted to create a backdoor that allows them to sell the asset on? How good is the security isn’t known. Is there trust? Have they made a secret deal? Will they play ball?

In the sense of this discussion: Non Fungible means ‘unique’ and cannot be replacted or another one exactly the same reproduced.

What gives something non fungibility? There can be only one! A great line from Highlander. To guarantee the item is unique, a one off, by itself or part of a fixed number of original pieces/parts that form the whole. NFTs as currently engineered using blockchains cannot guarantee this. This is because all data can be copied, edited and changed unless it is smart data, and why ‘block headers’ in a Bitcoin blockchain become part of the next block and so on for immutability continuity, but also a show of strength confirming nothing has been changed in the chain.

Yes NFT platforms will tell you its all good and there blockchain talks to other blockchains and handle this automatically. Confirming NFTs are indeed original, the artwork cannot be copied or tampered with, the JPEG is original. Unfortunately the bad news is blockchains do not talk to one another, not easily or at all. And data unless it is smart data cannot protect its provenance and cannot be provably unique. Uniqueness cannot be guaranteed on any level, even when. a third party notary claims to have a record of the truth?

All smart contracts struggle to interoperate, however they do call for information and/or wait for inputs. Which could be for example: we’ve received 10 BTC from this sucker, its time to sell the asset again or move it, or delete any record linking the worthless ‘token’ in your wallet to it. After all the asset isn’t recorded with the token exchange. This gap is called a Byzantine Fault and its very bad.

NFTs are brilliant and they can work

The only way for NFTs to work is for the token exchange and asset exchange in to be done at the same time, timestamped, an held on the same ledger, in one computational action (a smart data transaction). This is a true value exchange and why our current capital markets still operate and haven’t yet collapsed.

The only way for NFTs to work is for the token to be replaced by the asset itself, and record the full transaction in what is called a dual or proper double entry, thus creating something called a Non Fungible Asset.

This is where the token and asset exchange happens atomically within the same blockchain tech stack and yes you guessed it, is written to a single file (version of truth), where there is a commercial basis, identity disclosure and law to reflect the buyer and seller agreement.

Let us think about this some more. Bob sends Alice 10BTC and Alice sends Bob the deeds, the rights, the access and ownership of the asset directly, in a binding transaction under a legal jurisdiction. Within this dual double entry transaction on a decentralised ledger and storage that becomes instantly auditable, a real time validation of proofs, where all details of the identity of both parties — yes shock horror, the details of the asset (provenance) and the commercial principles of the deal, as well as the price discovery are bound as a single transaction. This is called ‘real value exchange’ and only this can support NFA — Non Fungible Assets.

Tokens have NO value, only assets do. And so any time you want to buy an asset make sure what you paid is recorded at the point/time of purchased. Its no good having a record on Etherscan of your token exchange/pledge/gift. That is not a proof of anything other than a token movement! NFTs must come with a receipt and a confirmation of the shift in title, rights and ownership, or licensing arrangement. Yes some evidence of the value and thus how the price was established would be nice, rather than someone simply setting the token price randomly, because they can. All of this has to be compiled into a ‘smart data’ file that gives the transaction true value. By giving the ‘data’ true value. Value that can be exchange traded immediately and audited immediately, in one place, atomically within one blockchain stack.

One last thing. Remember tokens have no intrinsic value. They are not linked to value. They are given value by parties of the market, unless they are a protocol token that follows Metcalf’s Law — that respond to economic activity of participants in a network, and how ethereum works. Just remember making something scarce doesn’t guarantee its future value will increase. Other factors apply — liquidity of an active secondary markets are needed where all trades have to happen atomically — machine 2 machine. Only then it works.

Non Fungible Assets are the answer, and there is only one Blockchain ‘smart data’ protocol today that can write both sides of the transaction at the same time, in the same stack, running datanomics alongside tokenomics and this is because the protocol makes the data about the asset and the transaction smart.

How do Non Fungible Assets (NFAs) work better than NFTs?

The problem the Blockchain industry is facing is that to engineer suitable solutions requires multiple chains, and an array of ‘smart contracts’ that actually create ‘Byzantine faults’ but also some centralisation effects requiring for example a Notary function, or Storage function — requiring entry and exit fees and prevents real time audit of all NFTs participants. Its a mess.

NFTs are a different colour ‘lipstick on the pig’ and dont address the real issue. How to record both sides of the deal — token exchange and asset exchange in the same transaction and stack?

The issue is always ‘data’ because in its native form it can be Copied and Edited so everything falls apart and all bets are off. You need a Digital Infrastructure supports a ‘smart data’ protocol that makes all data smart so that it can be ‘tracked and traced’ and is verifiably ‘unique’ where its ‘state’ the important part in computer science is known and can be seen. The owner and the intrinsic rights of the data (owner and access) are known, valued and managed.

So do not be taken in by the hype. NFTs are a great concept and the idea that anyone can create value and sell their IP using the NFT principle is interesting, Music artists, coders, game designers can fund their actities and get a return on their efforts. But the fundamentals need to be in place. Identity based ownership of the people involved and the validation of the asset, the underlying IP and title, that comes with rights of redemption and ownership.

Remember this — just because someone has access (holds the privarte key) doesn’t mean they own it! NFTs do not give ownership rights, just access, NFA’s do both.

Non Fungible Assets is the answer. Using tokens for what they are good at — a proxy for payment, nothing else.

If you want to know how to create NFAs or fix the NFT problems there is only one company I know that can do this, and I am happy to share.

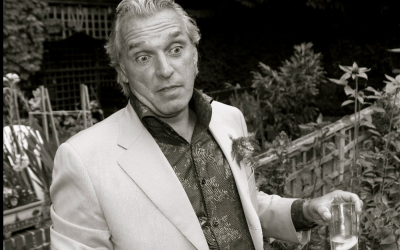

About the Author.

Nick Ayton serves as General Partner at Solarix-Ventures and is a board advisor to several firms. He is a Deep Tech specilist working across Blockchain, Ai, Quantum Computing, Neuromorphic Technologies.

Author. © Nick Ayton 2021